Introduction

The MacBook Air revolutionized the laptop industry when it launched in 2008, offering a sleek, lightweight design that changed the way we think about portable computing. But did you know that investing in Apple stock at the same time could have been equally transformative for your wealth? Let’s explore how much you’d have today if you had invested in Apple stock alongside buying the MacBook Air—and how you can enjoy the best of both worlds: cutting-edge tech and smart investing.

The MacBook Air Launch

On January 15, 2008, Apple unveiled the first MacBook Air, calling it the “world’s thinnest notebook.”

The original MacBook Air was priced at $1,799 for the base model.

Apple Stock Price in 2008

At the time of the MacBook Air launch, Apple’s stock was trading at approximately $15.80 per share (adjusted for splits).

Investment Growth Calculation

If you had invested the same amount you spent on a MacBook Air in Apple stock, here’s how much you’d have today (as of March 17, 2025):

For the Base Model ($1,799 Investment):

- $1,799 would have bought ~114 shares of Apple stock.

- Based on calculations from StockGainsCalculator.com, the investment would be worth $18,224.85 today.

- Gain: $16,425.85 (913.05%)

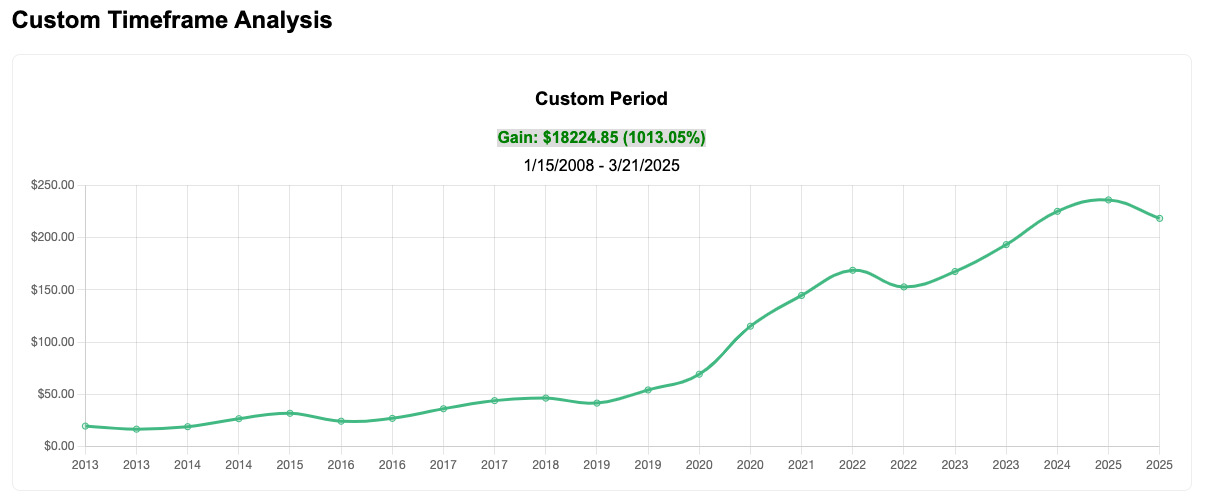

Visualizing the Growth

Here’s a breakdown of the growth over time:

Custom Timeframe Analysis for MacBook Air ($1,799 Investment):

Gain: $16,425.85 (913.05%)

Timeframe: 1/15/2008 - 3/17/2025

Key Takeaways

- Investing in Apple stock when the MacBook Air launched would have been a game-changer, yielding over 10x returns.

- The MacBook Air was a groundbreaking device, and Apple’s stock growth shows the power of investing in innovative companies.

- You don’t have to choose between enjoying cutting-edge tech and building wealth—both can be part of a balanced financial strategy.

- Tools like StockGainsCalculator.com make it easy to explore similar scenarios for other stocks and timeframes.

Call to Action

- Use StockGainsCalculator.com to explore similar scenarios for other stocks and see how investing can work for you.

- If you’re ready to upgrade to the latest MacBook Air, check out the:

- 13-inch MacBook Air with M4 chip for a perfect balance of portability and performance.

- 15-inch MacBook Air with M4 chip for a larger display and enhanced productivity.

Conclusion

The MacBook Air was a revolutionary product, and investing in Apple stock at the same time would have been an incredibly smart move. While past performance doesn’t guarantee future results, this example shows the potential of long-term investing in innovative companies. Whether you’re buying the latest MacBook Air or investing in the stock market, the key is to make informed decisions that align with your goals.

Investing Resources

For more investing tips and tools, check out our Investing Resources.

Photo Credit

Photo by Alejandro Escamilla on Unsplash.

Affiliate Disclosure

As an Amazon Associate, I earn from qualifying purchases.